This article provides an overview of Elevate Capital, emphasizing its commitment to supporting diverse founders. It reviews the current state of the venture capital industry, highlighting the fluctuating investment trends and how to improve the Oregon ecosystem. Additionally, it delves into the specific challenges Oregon faces in attracting venture capital investments and how Oregon is well-positioned to take advantage of current industry trends.

Elevate Capital Overview

Founded in 2016, Elevate Capital is a mission-driven venture capital firm based in Hillsboro, Oregon, but with a national reach. At its core, Elevate seeks to find, support, and promote diverse founders and founding teams. Investing in diversity is not just a moral imperative for Elevate, it is also a strong economic thesis. Myriad studies demonstrate the power of diverse teams to outperform homogenous teams.

Nevertheless, the venture community broadly has not embraced diversity as a key success metric, providing ample room for Elevate and like-minded firms to flourish. To wit, Elevate Capital Fund I, a 2016 vintage, has returned 125% of invested capital, with an internal rate of return of 22%, placing it just shy of the top quartile of all 2016 vintage Funds with less than $100M in assets under management (Pitchbook data, n.d.).

The Elevate family of funds demonstrates this commitment, with 83% of portfolio companies led by diverse teams, including over half with female leadership and just under 50% led by people of color. This commitment has deepened in lockstep with Elevate’s growth, exemplified by Elevate Capital Fund II having diverse leadership at 100% of portfolio companies. The value of diversity is not siloed, as Elevate has invested broadly across industries (from cleantech and life science to software to consumer products) and stages (from pre-seed to Series A).

Investing in diversity is not enough to ensure the success of nontraditional founders. Elevate’s team works hard to support founders across a variety of domains, including direct mentorship, access to other financial resources and investors, introductions to C-level executives as potential hires, and guidance on proper governance and strategic planning. This approach to mentor capital was borne out of the experiences had by the Elevate team and its origins in Portland, Oregon, a city known for valuing personal growth and well-being.

Elevate Capital does not exist without its Oregon roots, not only because a majority of its Limited Partners are from Oregon (including the State government) but also because the Oregon startup ecosystem has historically been more inclusive, supportive, and engaged than many others around the country. However, that support and engagement has waned in recent years, prompting the Elevate team to consider what they can do to revitalize the startup community.

Current State of the Venture Capital Industry

The 12 years following the financial crisis of 2007-2009 saw incredible robust growth in the venture capital and startup industry. The explosion in capital and successful companies was driven by several factors and industry trends, including a wholesale conversion to cloud-based software infrastructure, broad adoption of software as a service (SaaS), and the rise of mobile platforms and associated apps. In Oregon, two key factors drove this success: recognizing industry trends and attracting talent.

“We saw what the national trends were and tried to piggyback on them. We tried to surf those trends and make it easier for us,” said Kanth Gopalpur, Chair of Business Oregon Commission and Co-Chair of the Oregon Innovation Plan, speaking about the early days of his company Monsoon Commerce. “We had a net influx of young creative people moving into the city and wanting to get things done.”

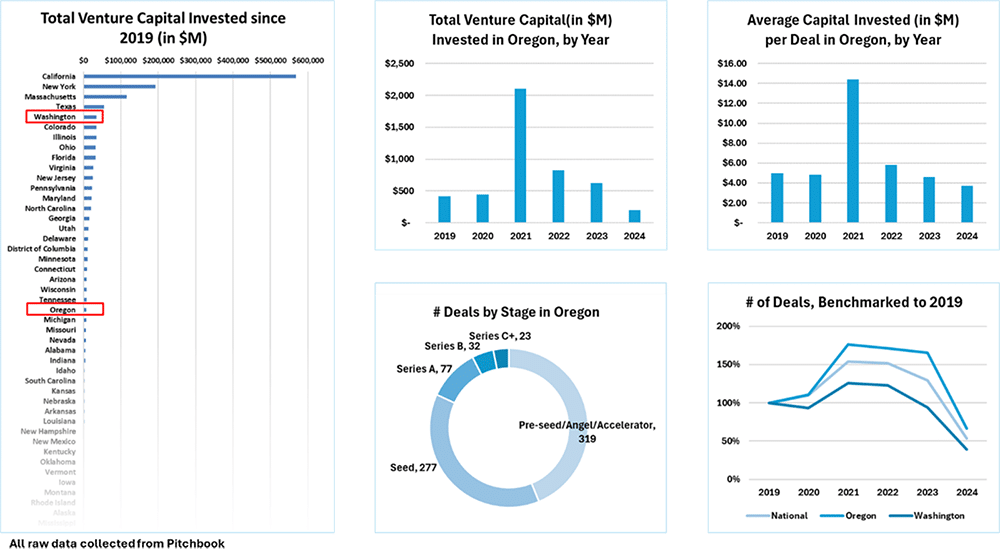

Despite the COVID pandemic essentially shutting down the economy for a large portion of 2020, the venture industry still outperformed 2019 levels, as measured by total capital deployed, total companies receiving investment, and total number of deals. 2021 saw a resurgence in startup activity and investing, culminating with an overheated 2022 market.

The collapse of Silicon Valley Bank and First Republic Bank in 2023 coupled with persistent inflation and rising interest rates served to cool investment activity, with a notable decrease across the country, a trend that continues in 2024. The Pacific Northwest has not been immune to the highs and lows of the venture capital industry, but it has notably lagged in its recovery.

In the first half of 2024, the venture industry nationally has invested almost 70% compared to all of 2019 and will likely exceed that year’s total by the end of the third quarter. By contrast, Oregon is on pace to just match 2019, having invested only 49% compared to 2019 levels; Washington is even farther behind, having invested only 34% of 2019 levels.

Surprisingly, Oregon has done more deals compared to 2019 (66%) than either Washington (39%) or the U.S. as a whole (53%). However, this increased deal activity has come at the cost of real dollars invested. The average size of each deal nationally is up 28% compared to 2019 while it is down by 26% in Oregon and 13% in Washington.

One interpretation of this trend is Oregon startups attract less funding per round because they are either too early to gain much national attention or there are competitors elsewhere that are outperforming them. Support for this view comes from the breakdown of deals between Oregon and Washington. Oregon is more heavily weighted towards pre-seed and Seed deals while Washington has more presence in the Seed and Series A funding rounds.

Being in the Pacific Northwest alone is not enough to explain the disparity in support for startups. Despite having less than double the population of Oregon (7.786M residents in WA vs 4.24M in OR), Washington attracts nearly ten times (10x) the capital investment that Oregon does. This difference is likely explained in part by a combination of focusing on different industries, access to talent, and legislation that traditionally encouraged business to grow and people to retain wealth in Washington.

The recent spate of IPOs with disastrous outcomes has tainted the perception that Oregon (and Southwest Washington) are unable to deliver the kinds of exits most venture investors seek.

Vacasa ($VCSA, 2021 IPO by SPAC, stock down 97%), Expensify ($EXFY, 2021 IPO, down 97%), ESS ($GWH, 2021 IPO by SPAC, down 96%), Laird Superfood ($LSF, 2020 IPO, down 88%), Absci ($ABSI, 2021 IPO, down 87%), and ZoomInfo ($ZI, 2020 IPO, down 67%) have all failed to provide the returns that a robust startup ecosystem needs to reinvest. Dutch Brothers, a decidedly non-tech company, has withstood this trend but is still only just recovering to its IPO levels ($BROS, 2021 IPO, down 5%).

Elevate Oregon Overview and Improving the Oregon Ecosystem

Elevate Capital created Elevate Oregon on May 30, 2024, as a forum to discuss what gaps exist in the infrastructure supporting Oregon’s innovation economy and what opportunities lie ahead. Attendees included not just founders and investors, but students, politicians, business leaders, service providers, and all those with a vested interest in seeing Oregon’s economy flourish.

The event was structured to encourage engagement and discourse rather than passive participation. Attendees heard from business and political leaders while also engaging in round table discussions about industry trends Oregon can capitalize on and brainstorming what needs to change to keep innovators here and attract new talent and capital.

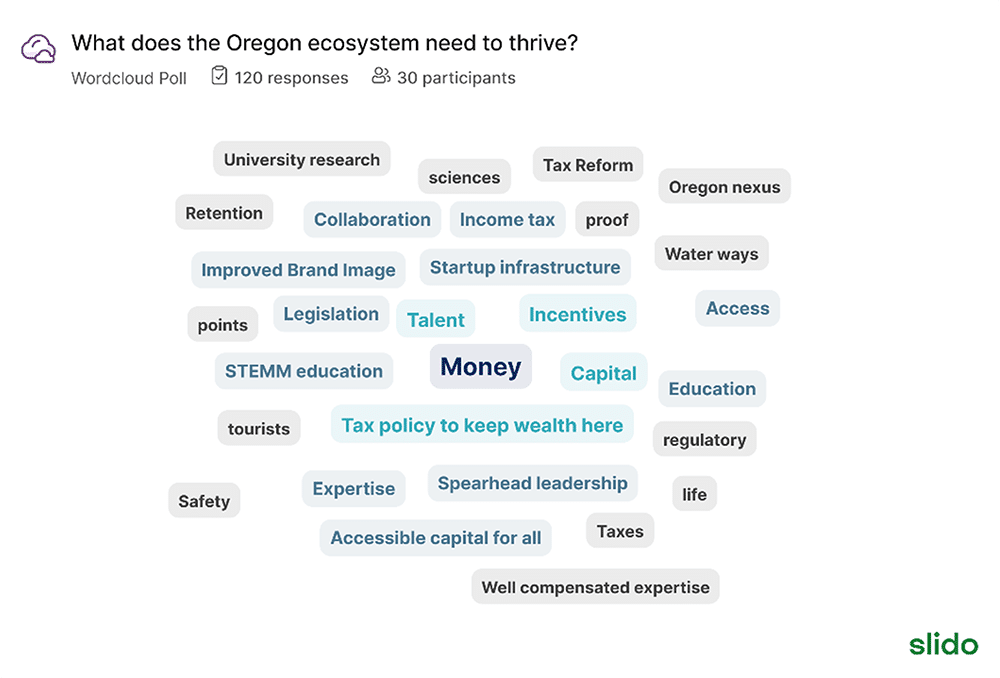

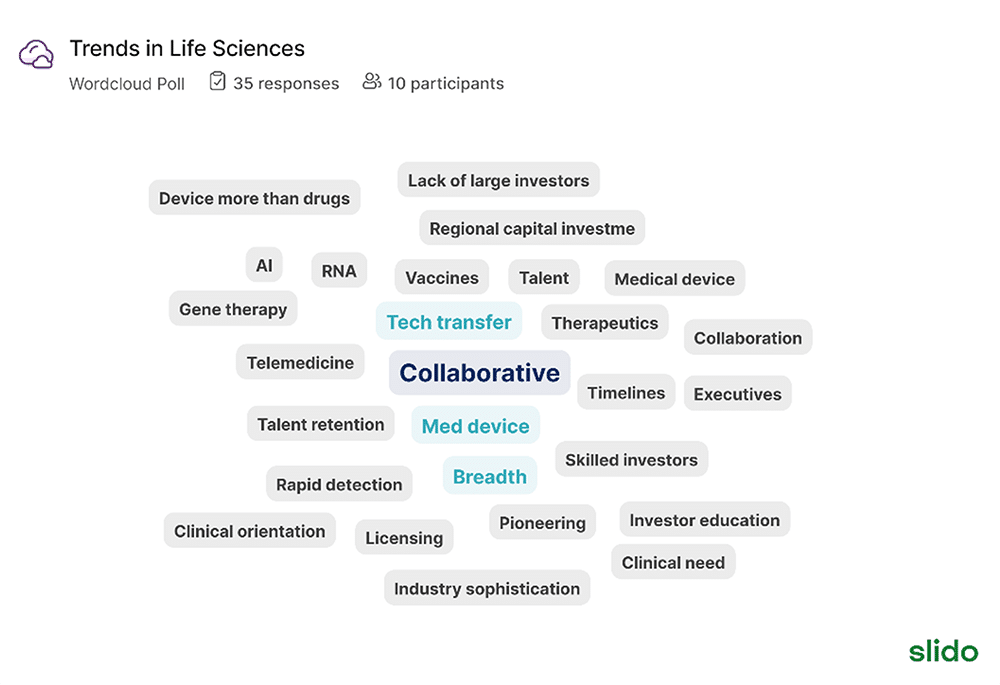

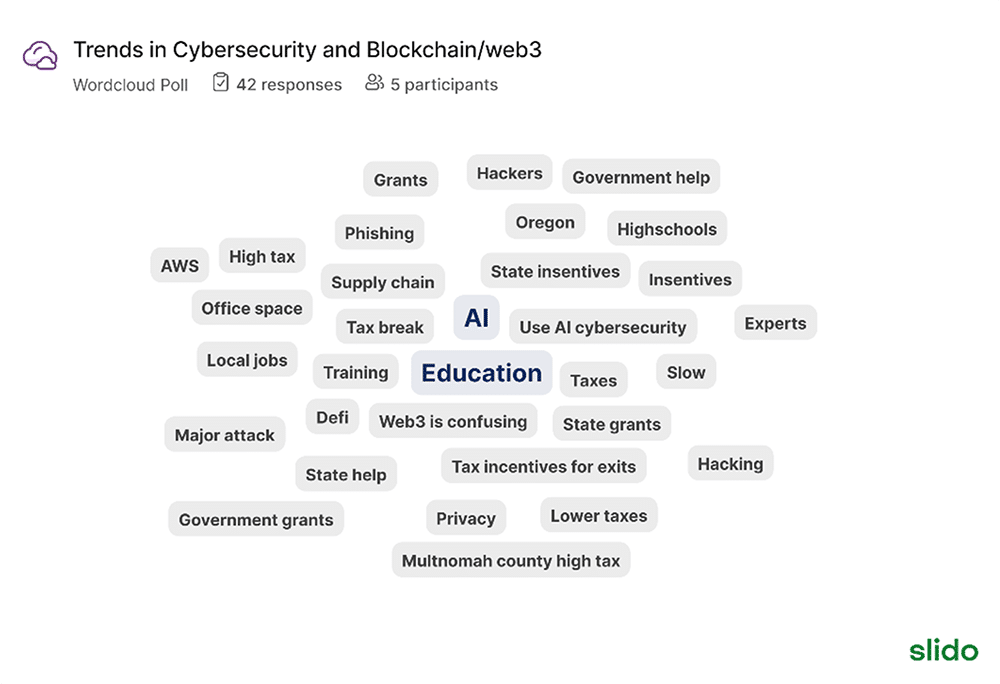

Feedback from these discussions was captured as Word Clouds to highlight key topics that can be used to form action plans and provide a foundation for those willing to step up and lead Oregon’s innovation economy for the next 25 years.

How to Improve the Oregon Ecosystem?

Access to capital was clearly identified as the key driving force to improve Oregon’s economy. But just obtaining money is not enough. Oregon needs to identify and act upon opportunities to attract new capital to the State. “There is no timing the market. Paddle your surfboard when the wave is coming and position it right to ride the wave,” said Monica Enand, Elevate Limited Partner and founder and former CEO of Zapproved.

Simply recycling existing capital within Oregon will not lead to growth opportunities and will likely cause Oregon to fall further behind its counterpart to the North and the rest of the country.

“As I’ve traveled around the country, I’ve seen several areas that have gotten energized. There is a lot of capital that has moved in and a lot of founders from other States. That success [is driven by] people moving in and capital following them,” said Nitin Rai, founder and Managing Partner of Elevate Capital.

Oregon does not need to create something from scratch. Other states have already implemented tax incentives, for instance, designed specifically to attract capital and companies.

The Maine Seed Capital Tax Credit Program offers income tax credits to investors worth up to 40% of their equity investment.

Louisiana has a similar Angel Investor Tax Credit that affords investors up to 25% credit for investing in early-stage, Louisiana-based startups.

Wyoming offers companies up to $2 million in tax credits over five years to relocate their headquarters to the state.

Oregon has a similar program, the Oregon Investment Advantage, but it is restricted to rural areas and excludes Multnomah, Washington, Clackamas, and Lane counties, among others. Most high growth companies want to be near commercial and urban centers, to attract talent and have access to resources and amenities. Pushing nearly all incentives to rural areas or restricting who has access (e.g. the Business Expansion Program, which requires companies to have at least 150 employees and plan to hire at least 50 more) discourages promising startups and aspiring founders from seeing Oregon as a place to build a business.

In parallel, Oregon needs to refresh its brand image to attract new talent as well. Capital will not create growth if the talent is not there to use it. “People think investing is math, but it is still a people business. The best investors understand what you’re doing is channeling energy to focus on people and ideas that matter. And if you focus on the right people and the right ideas, investment performance outcome is the result of a human interaction,” said Rukaiyah Adams, CEO of 1803 Fund.

Oregon already has significant advantages over many other parts of the country: access to natural resources, proximity to larger markets, and a progressive mindset. For tech workers in particular, quality of life is the primary consideration for where they live and who they work for (if not themselves). Oregon can provide that quality of life.

Opportunities for Oregon Innovation

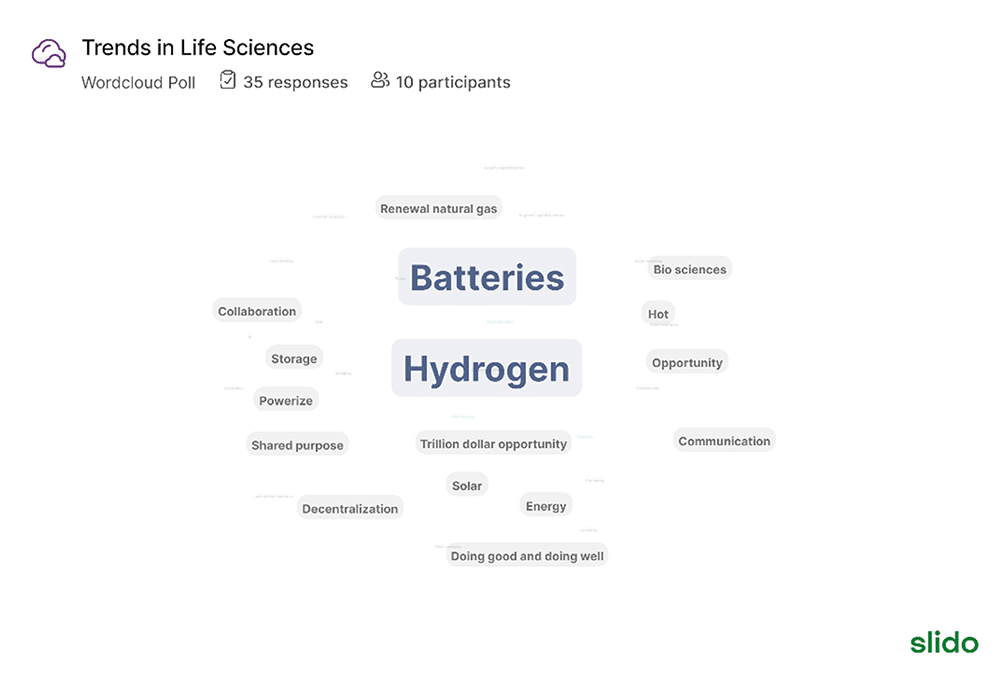

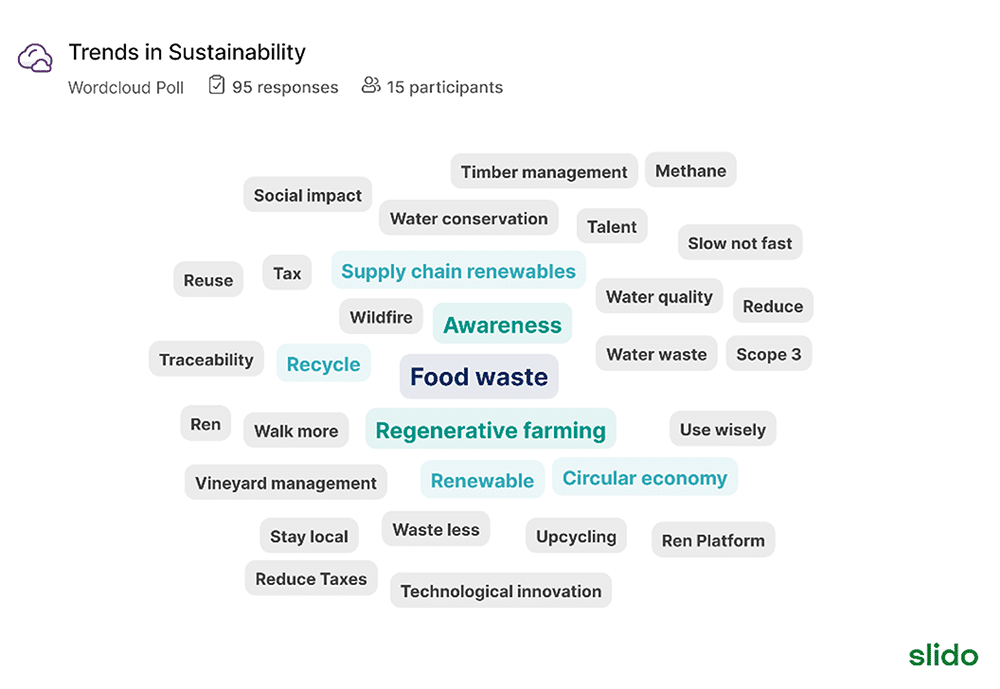

Aside from capital, Oregon is well-positioned to take advantage of current industry trends. These are trends that will hopefully lead to sustainable innovation and power Oregon’s economy not just for the next five or ten years, but the next twenty, thirty, or forty years. Oregon has world class research institutions and a clear understanding of the value of natural resources (and the need to protect them).

“I see [climate change] as the single biggest economic opportunity for us to do good and do well at the same time,” said Kanth Gopalpur.

Energy management and post-consumer waste were identified as key areas that Oregon’s previous industries (e.g. forestry and timber, hydroelectric, semiconductors, and apparel) can all have a hand in promoting. Initiatives such as better planning for scarce resource management (especially water), access to sustainable, environmentally friendly food production, and thinking beyond local impact to Scope 2 and Scope 3 effects are all opportunities for new technologies to marry with existing established industry. Electrification of our abundant waterways is another opportunity.

“The waterway from Bonneville Dam to Astoria could be the country’s first electric river,” said Marcelino Alvarez, CEO of Photon Marine. Furthermore, these all fall within the State’s traded sector industries that are central to the 10-year Innovation Plan.

“We have to think about the future and how we evolve our company beyond [Nike, Intel, and legacy companies],” said Rukaiyah Adams. “I would start with natural resources.”

Similarly, the discussion around opportunities in life sciences centered on leveraging the resources Oregon already possesses. There was less emphasis on innovation by itself and much more on collaboration and education.

Despite world-class science being conducted at Oregon Health & Science University, technology is often locked away in labs. Improving access to this technology, broadcasting the insights and advances made by the faculty, and educating both the startup community at large and academic innovators in particular will help move these innovations from the lab, where they are scientific projects, to the commercial world where they can have meaningful benefit to people all over the world.

Here again, Oregon does not need to create this infrastructure from scratch. The University of Washington, through its CoMotion program, has set a standard for what academic technology transfer can become. CoMotion offers students, faculty, and academic scientists support throughout their entire startup journey, from basic pitch coaching and company formation to IP considerations to engaging with the external investment community for mentorship and participation at project demo days.

The high-profile lab of Dr. David Baker at UW is a particular benefit, but one that Oregon can match. Dr. Baker’s lab consistently creates new technologies that are spun out into companies, many of them highly successful.

At OHSU, Dr. Brian Druker’s lab at the Knight Cancer Institute has the same potential but far fewer people know about it in the Oregon startup ecosystem. Dr. Druker is credited with helping develop Gleevec, the first medication to specifically target chronic myeloid leukemia. Gleevec represented the birth of precision medicine in cancer treatment, changing the way patients received care and how scientists approached therapeutic development.

Finally, artificial intelligence was at the center of almost every discussion during Elevate Oregon and represents perhaps the greatest opportunity for sustained innovation and economic growth.

AI is finding its way into nearly every industry, from healthcare to operational efficiency to music and gaming to content creation and so on. This permeation must be met with strong governance at the technical, corporate, and federal levels. Any innovation in AI needs to come with clearly defined guard rails to protect data (especially patient and health data) and ensure privacy while engendering trust among users. Creating “observable” AI is key to this trend.

Much of the discussion around industry trends and new opportunities centered on research. Oregon has some support for companies with heavy research and development spend (e.g. the Business Oregon Matching Grant Program) but these opportunities do not afford the financial security necessary for long-term innovation in the traded sector industries identified in the Oregon Business Plan (Metals and Machinery, Bioscience, Forestry and Wood Products, etc.). Canada is a shining example of what government can do to support R&D.

The Canadian Scientific Research and Experimental Development (SR&ED) tax incentives work together to support research wholistically. Eligible research activities include basic research (i.e. the work needed to validate an idea at lab scale), applied research (i.e. taking that work beyond the lab to scale it up to industrial levels), experimental development (driving new technologies), and support work (e.g. data collection, analysis, engineering, design, etc.). The current SR&ED tax credit is 15% of eligible expenditures, which can be a significant sum for a life science company developing a new cancer therapeutic or a renewable energy company developing an electric boat motor, for instance.

Oregon’s 10-year Innovation Plan includes opportunities to establish regional hubs that support founders and startups through access to mentorship, capital, networking, and technical assistance. However, if those hubs are not aligned with other tax and financial incentives, they will do little to change the trajectory of Oregon’s startup economy.

Actionable Outcomes for Oregon’s Startup Economy

Changing the future of Oregon’s startup economy requires ambition coupled with performance. Advocacy remains a strong lever to effect change; however, political will is moved by results.

“If we want elected leaders to support policies that support the startup and entrepreneurial ecosystem, we have to demonstrate results,” said Tobias Read, State Treasurer. We encourage all who want to improve the Oregon startup community to engage with local and state policymakers to implement laws and incentives that support innovation and wealth creation rather than penalize.

“We need to succeed then give back to the community, and stay in Oregon,” said Kanth Gopalpur. “Get in front of city council and make sure your voice and needs are heard.”

At the same time, keeping the wisdom of investment local to Oregon is critical. Adams identified the brain drain that comes with outsourcing the Chief Investment Officer (CIO) role, a trend that is now worryingly common for large institutional investors (e.g. university endowments and pension funds). “If we’re outsourcing investment decision-making, it’s really hard for people who live in other places to be invested in the talent here. If you sit on those [OCIO] boards in other places, [encourage your board members to] spend time here.”

We also need to rebrand Oregon as an attractive place to move to and encourage founders to stay here to help attract more talent. That will not be achieved by looking back to the rest of the country.

“The strategy shouldn’t be replicating those models [in the Valley and North Carolina], the strategy should be, What do we have here that none of them have?” commented Rukaiyah Adams. “Our aspirations should be more in line with Taiwan and Singapore instead of Boston and Philadelphia. Our economy already looks East. But our thinking is geographically limited to our position in the United States. We need to be more ambitious about where we want to go with our economy than replicating other U.S. cities.”

And ultimately, we need to increase access to capital for all startups. That means having honest discussions about what success looks like for both founders and investors.

“One of the challenges for growth here, and there will be growth whether we control it or not, will be the alignment of private capital within the State, the attraction of private capital from outside the State, and the alignment of those two sources of capital with public capital,” commented Rukaiyah Adams. “There’s a lot of community building here and growth on paper, but if the investing doesn’t come back financially, all the talk just doesn’t work. It’s been hard to have a conversation about what is investable for institutional investors. If we don’t have the return capital, it’s hard for CIOs to keep putting capital to work.”

At Elevate Capital, we firmly believe in the future success of the Oregon startup community. But we want to be clear-eyed about the challenges we face and the opportunities we have to overcome them. This article is intended to provide a foundation for founders and investors to have honest conversations about what success means here and the collaborative efforts we can take to realize that success.

This article was authored by Ben Nahir, PhD, MBA, Venture Principal with Elevate Capital.

Article Sources:

E.g. Carucci, Ron. One More Time: Why Diversity Leads to Better Team Performance. Forbes, Jan 24, 2024.

FAME Maine, Maine Seed Capital Tax Credit Program, FAME 40

Louisiana Economic Development, Louisiana Business Incentives

Wyoming Business, Incentives for Your Dream

Business Oregon, Investment Incentives

Business Oregon, SBIR/STTR Matching Grant Program

Business Oregon, Oregon’s Target Industries

Government of Canada, Scientific Research and Experimental Development (SR&ED) tax incentives