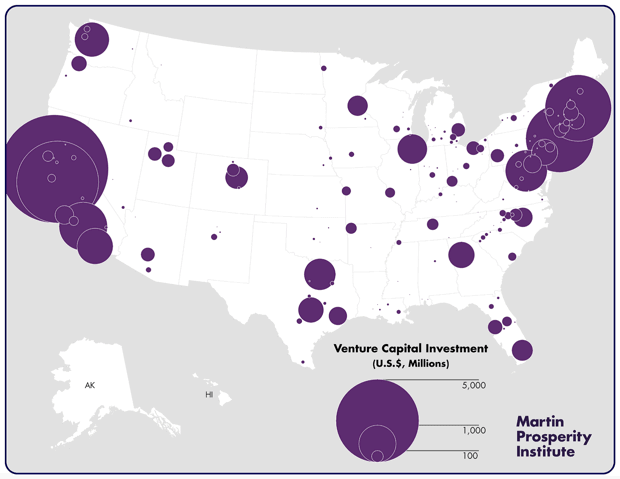

While venture capital has been the fuel that powers innovation in America, it has long been concentrated in select major cities across the country. Given that the country’s most powerful and fastest-growing companies are clustered in hubs like the Silicon Valley, New York City, and Seattle, it’s not surprising that venture capital shares a similar concentration.Geography plays a huge role in the venture capital ecosystem.

A report by CityLab tracked venture capital investment and startup activity across U.S. cities and found that venture capital investments are extremely concentrated in specific regions while other regions show very little investment activity. The ten largest cities in the United States for venture capital investment account for 77.6% of all US venture capital investments. The largest hubs for venture capital investments in the United States include the Bay Area, the Bos-Wash Corridor (including Boston, New York, and Washington D.C.), and cities across the West Coast including Los Angeles and Seattle.

Image Source: City Lab

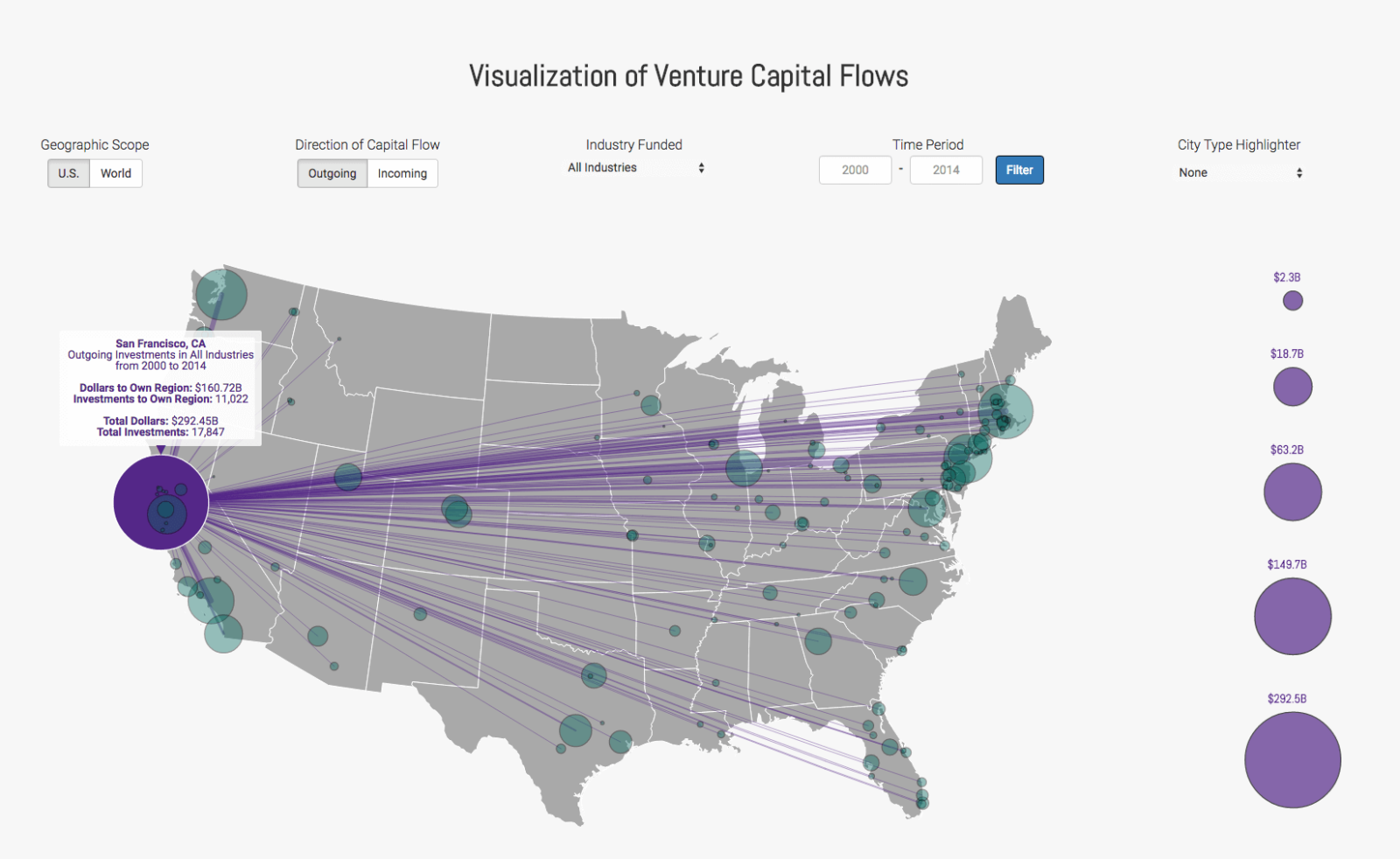

To further break down America’s venture capital landscape, a team of Harvard researchers analyzed and spatially visualized 57,000 venture capital investments from 2000-2014. Their findings suggested recurring patterns of investment activity that they used to classify cities into four categories. They used two metrics to gauge domestic investment activity – the percentage of money that VC firms invested in companies within the same city and the amount of money that companies raised from investors within the same city as a percentage of the total amount of funds raised.

From these metrics, the researchers found, once again, that geography plays a huge role within the venture ecosystem.The first city classification is called a self-sustaining city. It is characterized by substantial domestic investments by local firms. This creates a cycle in which more investments result in more successful companies causing more companies to relocate to the area. The results of which spur more funding and cause the cycle to repeat. San Francisco and Boston are self-sustaining cities that fall into this classification.

New York City, the second-largest hub for venture capital investment in the United States, falls into the second classification, a finance center. This classification is characterized by disproportionately high venture capital for the number of startups present in the city. Finance centers are the opposite of tech hubs in that the startups in these cities are well-funded by local investors. However, the majority of NYC-based venture capital dollars go towards financing startups in other cities.

Image Source: City Lab

The third classification of the city is tech hubs which are areas that have experienced a disproportionate inflow of investment money. In tech hubs like Salt Lake City, Austin, and North Carolina’s research triangle of Raleigh, Durham, Cary, and Chapel Hill, the percentage of outside investments flowing into the cities is much larger than the percentage of local investments.

Lastly, the fourth classification is spatially mismatched cities. These are cities that cannot be categorized as tech hubs, self-sustaining cities, or finance centers because of low venture capital and startup activity. In spatially mismatched cities, companies aren’t raising money from local firms or external players at a significant level. Investors from these areas put money into startups in other cities.

Portland, Oregon is an up-and-coming startup region that cannot yet be characterized as a tech hub, self-sustaining city, or finance center. However, there is still plenty of opportunity for future venture capital growth within the city. One of the main qualities that Portland currently lacks is a critical mass of investment dollars. Additionally, Portland doesn’t have any of the “unicorn” startups and only has one candidate for an IPO – Puppet, a network automation company that has delayed IPO plans indefinitely.

However, while startups don’t play nearly as important a role in Oregon’s economy as they do in California and Washington, new businesses are essential to any state’s economic future. A large amount of investment money currently flows across the United States (nearly $60 billion in 2015 alone). However, venture capital investment is found in just half of America’s 366 metro areas.

Funds like Elevate Capital aim to attract more entrepreneurs and more investors to the Portland region, which lags behind places like Seattle and San Francisco as far as total angel investment and venture capital dollar. Oregon is a state ripe for investment and Portland is a city with vast potential for becoming home to even more successful startups.

Over the last decade, Oregon’s startup ecosystem has matured significantly. Oregon startup investments of over $1 million have increased sevenfold over the past 11 years. Portland already has a healthy tech ecosystem with several major players including Elemental Technologies sold to Amazon in 2015, Zapproved which raised a $60 million round of funding, and Puppet which employs hundreds of workers in a 75,000 square foot offices in downtown Portland.

The venture capital and startup activity trend for Portland, Oregon remains very much in an upward curve. Elevate Capital is building the pipeline of the next generation of successful startups by investing in very early-stage companies as lead investor and creating investment syndicates for follow up capital to grow. Additionally, we provide the best mentoring and advice to our portfolio founders and CEOs.