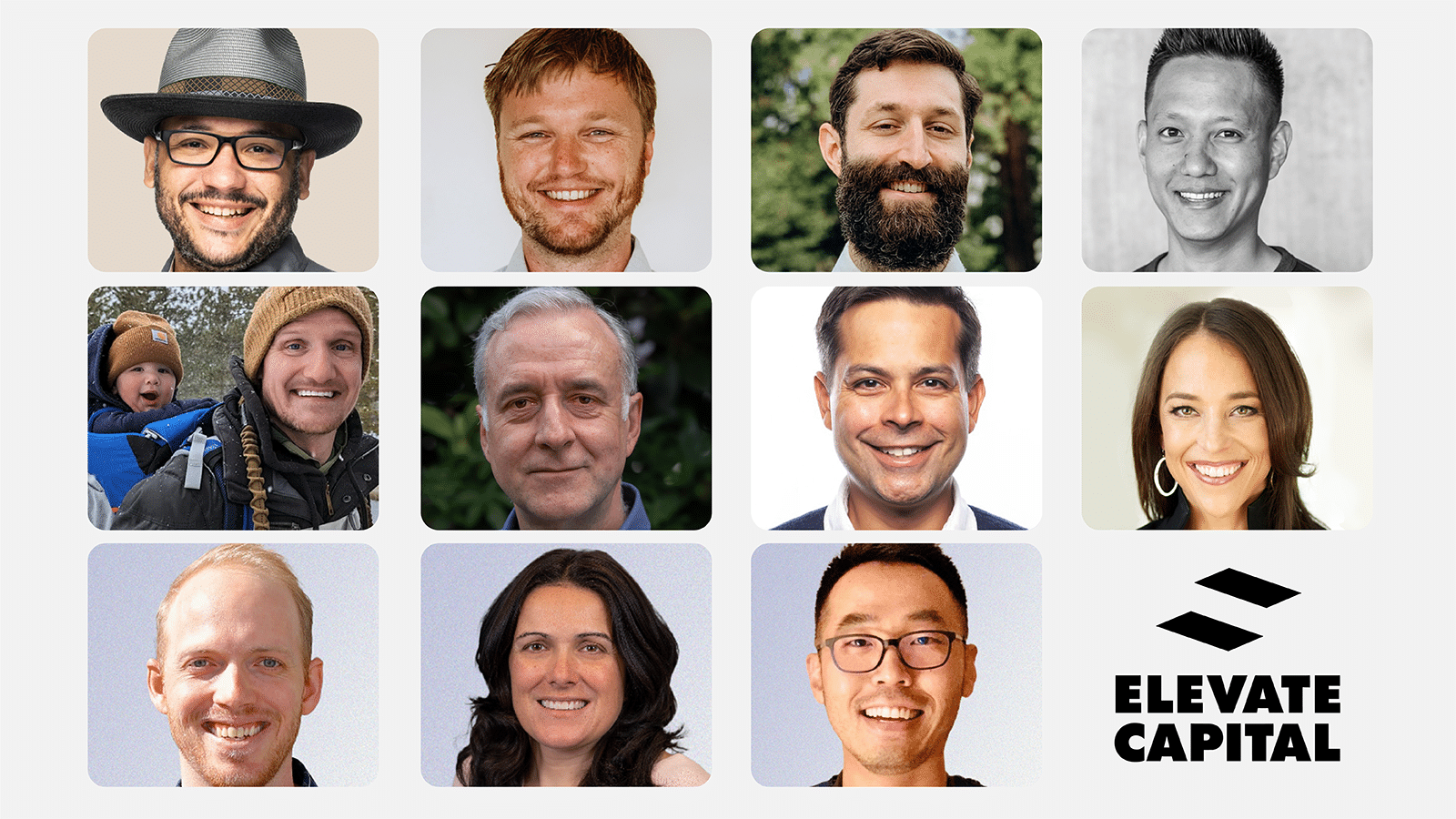

Creating Opportunity, Building Legacy: Highlights from the 2025 Elevate Capital Annual Investor Events

Elevate Capital’s 2025 Annual Investor Reception and Meeting showcased the power of inclusive venture capital. With $60M AUM and 88 investments, Elevate is building generational wealth and backing bold, underrepresented founders. Read on for impact highlights, founder stories, and what’s next in mentorship-driven VC.